When it comes time to price your products or service, you may be struggling with the numbers. "Helpful" advice like, "Well, how much do you want to make?" can cause you to bring your pinky finger to your lips and exclaim, "One million dollars!" Unfortunately, while that would be lovely, it’s not realistic for most businesses.

.jpg)

What’s more realistic is understanding how your customers perceive the value of your product and asking them what they’d be willing to pay for it. Having this number will allow you to set a fair price for your product or service that makes you money while providing the value and quality your customers expect.

Willingness to Pay

Pricing your products properly can mean the difference between a successful product launch and a product line (or service) that falls flat. "It's probably the toughest thing there is to do," says Charles Toftoy, associate professor of management science at George Washington University. "It's part art and part science."

In consumers’ minds, a price represents two distinct numbers: how much money they have to give up, and the level of quality of the item. Price too high and your customers won’t want to part with their money. Price too low and they’ll doubt the quality of your product.

This is why understanding Willingness to Pay is so important.

What is willingness to pay?

Willingness to Pay (or WTP) is just that… the highest amount your customer is willing to pay for a product or service. It’s generally expressed as a range to represent different people’s opinions and also the fluctuation over time.

WTP can be influenced by a number of factors including:

- The economy. When the economy is doing well, people are more comfortable paying more for a product. During a recession, you’ll see WTP decrease.

- Product popularity or timeliness. It goes without saying that consumers would be willing to pay more for a Halloween costume in October than they would in March. The same goes for other holidays, seasonal items, and so on. While WTP varies throughout the year, it’s fairly easy to track from one year to the next. Popularity is another story. When a product becomes wildly popular, people’s WTP will increase. This is more difficult to track so you’ll want to pay close attention to any changes occurring in your market.

- Scarcity. When consumers believe that your product is rare or difficult to find, they’ll be willing to pay more to get their hands on it. Consider the great Cabbage Patch wars of the ’80s or the Tickle Me Elmo craze of the late ’90s.

- Quality. The higher the quality of a product or service, the more people will be willing to pay for it. The challenge here is that shoppers will often use the price to judge the quality. "They can’t judge the quality independently, so instead rely on the price," says Mark Stiving, Ph.D. "This happens because they experience higher quality products being more expensive on products where they can judge quality. Hence, they correlate price to quality. Now, think about buying wine. You stand in front of the wine aisle, not knowing any of the brands. So you choose based on how much you want to spend. The more you spend, the better the wine … you hope."

- Consumers' own price points. Depending on income, history, and a number of other factors, WTP will vary from one customer to the next. If you segment your data using these factors, you’ll have a better understanding of how to price your product and create pricing tiers that will appeal to multiple demographics.

- Needs and desires. Obviously, if a consumer feels they need or want a product more, they’ll be willing to pay more. If your product can positively influence one of their goals or fix one of their problems, their WTP will be higher.

- Sustainability. Is your product cruelty-free or environmentally friendly? Is your brand known for taking good care of employees’ physical, mental, and emotional health? Do a portion of proceeds go to a charity in support of a cause? The Global Sustainability Study 2021, found that one-third of customers (34%) are willing to pay more for sustainable products and say they would accept a 25% premium on average.

With this knowledge, let’s take a look at how you can calculate WTP.

How to Calculate Willingness to Pay

It would be great if there was a simple and straightforward equation to calculate willingness to pay. Unfortunately, humans are often irrational creatures and any equation economists could come up with, would only tell half the story.

Don’t lose hope just yet. While there’s no hard and fast rule, there are methods you can use to discover the WTP range for your product or service. These include:

Researching the Competition

How many other companies sell what you sell? If you are the only one in your market or share the space with just a handful of companies, you’ll have more freedom when it comes to setting your prices.

If the market is saturated and consumers can’t make it more than two feet without tripping over one of your competitors, people won’t be willing to pay as much for your product. If the latter is the case, you’ll need to charge around the same as other companies offering a similar product.

Researching your Customers

What do your potential customers want out of your product? Does your product offer those features? The better you meet your customers’ needs, the more likely they’ll be to pay more for your product.

Surveying Customers

Surveys can be a powerful tool when it comes to learning about your customers. They give you the opportunity to find out how loyal customers are to your brand or to competitors, what features they want and truly value in a product, and what their maximum price point would be for a product.

While you’ll want to keep an eye on the market at all times, there are a few instances when it’s essential to do the research and calculate WTP. These include:

- Product launches. You can charge a little bit more to cover your research and development and appeal to early adopters who are eager to have the best new toys and happy to pay a premium for them.

- When entering a new market. Now is the time to determine if you have a competitive advantage in the marketplace and whether you’ll be able to sell at a price that is profitable for you and attractive to consumers.

Willingness to Pay in Practice

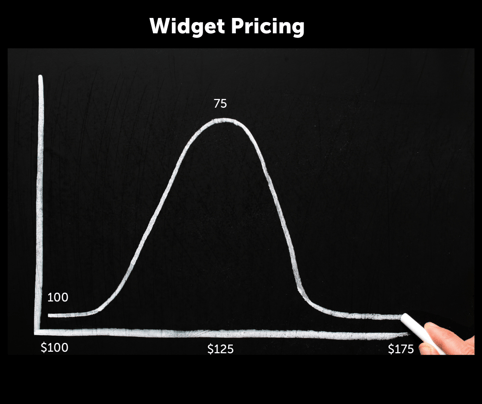

Let’s pretend that your company sells widgets. For ease of calculations, there are 100 consumers in your target market. You survey them and find that your product fits their needs, there are a few competitors in the space, however, it’s not oversaturated yet.

You send out a survey and discover that on the low end, customers would be willing to pay $100 for your widgets, and on the high end, they’d be willing to pay $175. This is important to note, however, more important is where the vast majority of consumers fall in this range.

75 of the people you surveyed said they’d be willing to buy your product for $125. It costs you $50 to make, so your profit would be $75 x 75 people = $5,625.

If you choose to charge $100, all 100 people surveyed will purchase your product. However, as you’ll only make $50 on each item sold, you’re looking at $50 x 100 people = $5,000. You might make more sales, but you’ve actually made less money.

Factor in the extra work your widget manufacturing and fulfillment team will have to do, and consider the extra customer service and support that you’ll need for another 25 customers, and your actual profit may be even less.

A business can only thrive when the prices it charges for products and services work for both the business and the consumer. If you charge less than you need to, you won’t be able to pay your bills and you’ll be out of business in no time. If you charge more than customers are willing to pay, you’ll have no customers to sell to.

As Charles Toftoy said, finding the sweet spot is both an art and a science. However, when you find the right price, your products will be selling like hotcakes.

Pricing Strategy

![B2B Pricing Models & Strategies [+ Pros and Cons of Each]](https://2406023.fs1.hubspotusercontent-na1.net/hubfs/2406023/Imported_Blog_Media/b2b-pricing-models-and-strategies.jpg)

.jpg)

.jpg)

.jpg)

.jpg)