Any functioning business needs to keep careful tabs on its expenses. Tracking, documenting, and ultimately reporting how the company spent money in a given year is central to understanding its long-term viability and financial wellbeing.

Some expenses are relatively consistent — the ones that go into funding the organization's ongoing, day-to-day operations. But businesses can't stop there. They still have to account for one-off, often unexpected costs that pop up from time to time.

Those are most commonly referred to as non-operating expenses. Here, we'll explore that concept a bit further, differentiate those costs from operating expenses, see where they fall on most income statements, and review some examples of what they might look like.

What are non-operating expenses?

The term 'non-operating expense' encompasses any cost a company incurs that isn't directly related to its core business operations. Non-operating expenses are typically accounted for on the bottom of a business's income statement.

Non-operating expenses are often conflated with operating expenses, but for the sake of sound financial reporting and accounting purposes, it's important to distinguish one from the other.

Operating vs Non-Operating Expenses

Operating expenses represent costs that businesses need to incur to carry out their day-to-day operations. That can include expenses related to staff salaries, office space rent, or marketing efforts.

A company's operating expenses are much more indicative of the health and performance of that business. They can be used to help frame how recurring investments are playing into the organization's financial wellbeing.

Non-operating expenses tend to be more "one-off" and isolated. Generally speaking, a business doesn't consistently incur the same non-operating expenses on an ongoing basis. That's why separating the two types of expenses in financial reporting is so important.

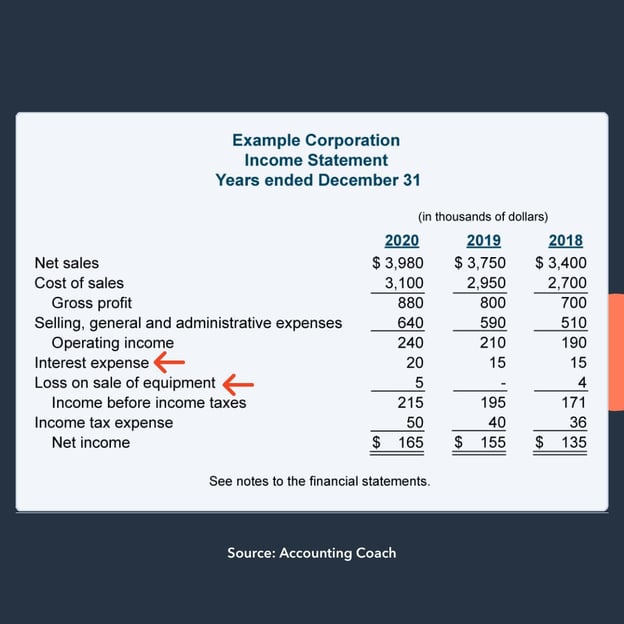

Non-operating expenses are typically listed below operating expenses on an income statement — as combining the two might undermine or distort how a company is actually performing. Here's a look at what that might look like:

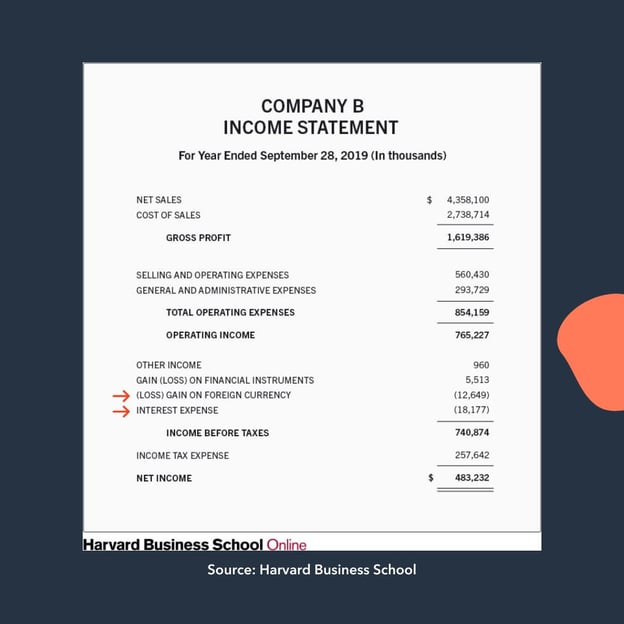

Here's another example of how non-operating expenses might show up on an income statement.

Now that we've seen how operating expenses arise and where to look for them on an income statement, let's take a look at some examples.

Non-Operating Expenses Examples

- Legal Fees and Settlements

- Interest Payments on Corporate Debt

- Selling Company Real Estate at a Loss

- Losses From Investments

- Losses Due to Natural Disasters

- Restructuring Costs

- Losses on Sale of Equipment

1. Legal Fees and Settlements

Any legal fees or settlements from litigation your company deals with constitute non-operating expenses.

2. Interest Payments on Corporate Debt

If your business opts to take on loans to help spur growth, any interest payments you make qualify as non-operating expenses.

3. Selling Company Real Estate at a Loss

If your company sells property it owns for less than it was initially purchased for, the difference is considered a non-operating expense.

4. Losses from Investments

Your business might invest in companies, commodities, or other opportunities — if those ventures don't pan out, you record those losses as non-operating expenses.

5. Losses Due to Natural Disasters

Sometimes, your business incurs costs stemming from one-off instances like natural disasters. Those losses are recorded as non-operating expenses.

6. Restructuring Costs

If leadership at your company restructures how the organization operates, the costs associated with those changes are considered non-operating expenses.

7. Losses on Sale of Equipment

If you sell equipment you use for production at a loss, that difference is recorded as a non-operating expense.

Planning for non-operating expenses is often tricky — if not impossible. You can rarely anticipate spontaneous losses that could come from factors like natural disasters or legal troubles.

Still, businesses need to account for these kinds of expenses as they come. Though they don't necessarily reflect a company's health or long-term viability, they still need to be covered in financial reporting and planned around as they emerge.

Sales Operations

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)