Two decades ago, it was hard to imagine a world where cash didn't exist. But with the rise in popularity of cashless payment methods, a society without cash could soon become a reality.

.jpg)

The COVID-19 pandemic is one major catalyst for the shift. To minimize direct contact, people gravitated towards payment methods that didn't require the use of physical money, like bank cards and payment apps.

In this article, you'll learn what experts think about the future of cashless payments, payment methods on the horizon, and companies that are already making the change.

Companies Testing Cashless Experiences

How to Set Up Cashless Payments

Adopt Cashless Payment Methods

Cashless Payment Predictions

The global transition to cashless payment methods is happening very quickly. Experts believe that before long, we'll be living in a cashless society. In fact, some countries are already working to completely eradicate cash from their economies.

Sweden has reduced the amount of cash in circulation by 50% over the last decade.

According to the European Payments Council, traditional cash transactions made up just 1% of Sweden's gross domestic product (GDP), and ATM cash withdrawals are steadily declining by 10% each year. The Swedish Central Bank recently stated that only 9% of the country's population uses cash for transactions right now.

Now, analysts predict that Sweden will become the first cashless nation in the world by 2023.

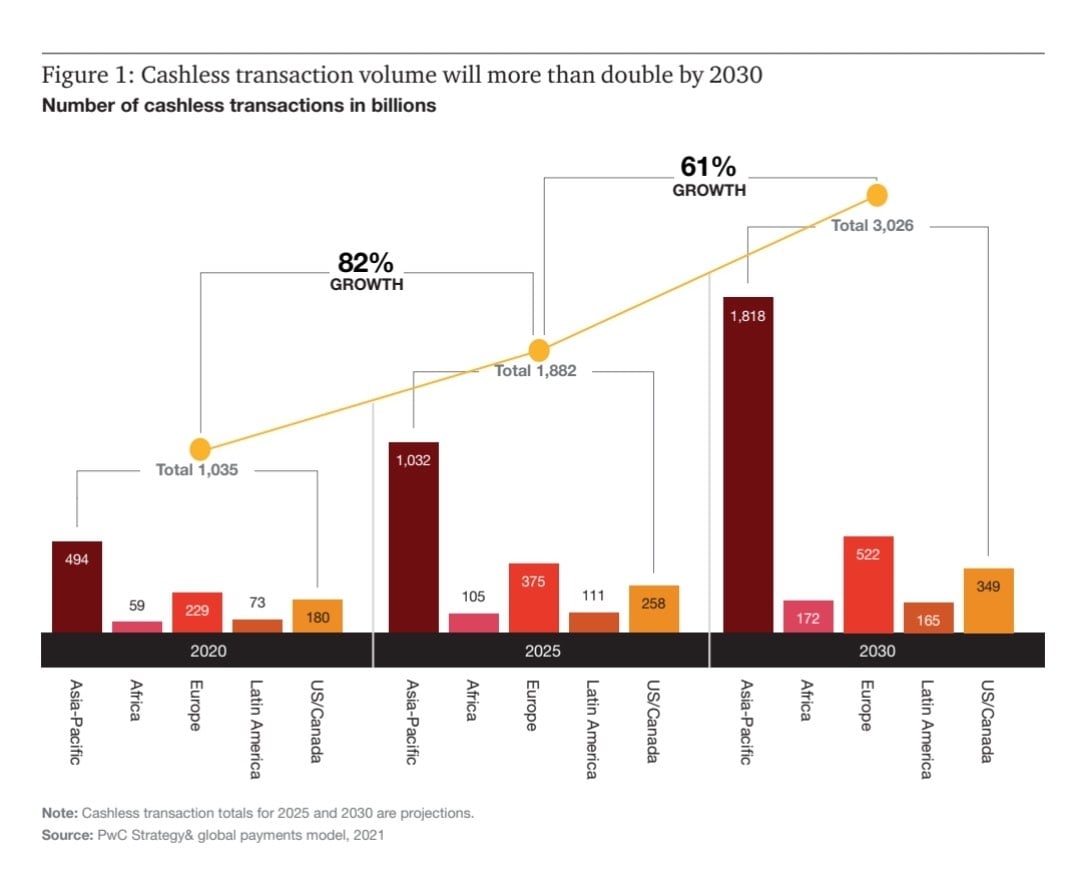

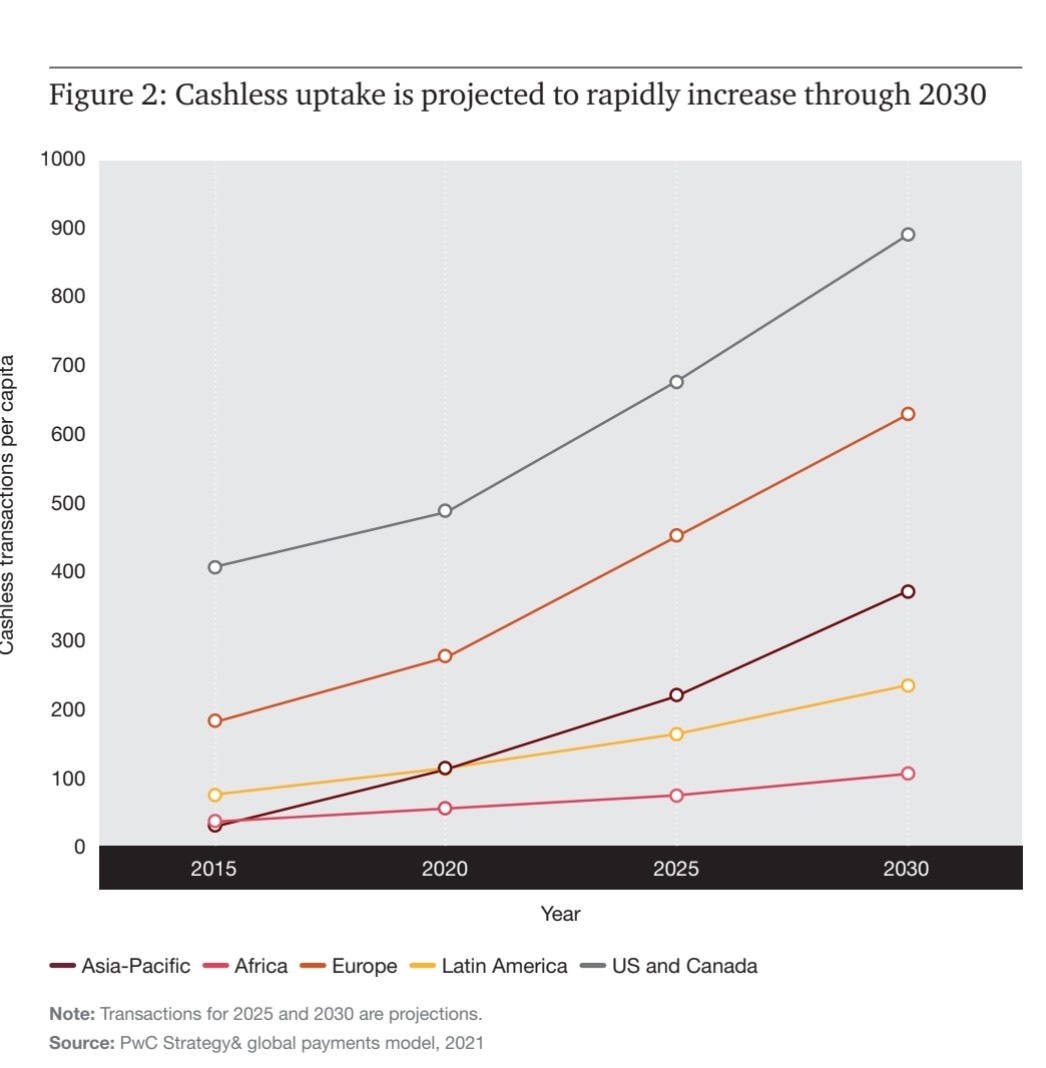

In PwC's 2025 & Beyond: Navigating the Payments Matrix, PwC explored the ongoing transition from cash-based to cashless payment methods, the development of digital economies, and the impact of new payment trends.

Here are some of the cashless payment predictions in the report:

- Cashless transactions will grow fastest in Asia-Pacific, increasing by 109% from 2020 to 2025, and then by 76% from 2025 to 2030, followed by Africa and Europe.

- Global cashless payment volumes are set to increase by more than 80% from 2020 to 2025, and to almost triple by 2030.

- 89% of respondents agreed that the consumer shift from physical stores to online stores will continue to increase, requiring significant investment in online payment solutions. Digital wallets will account for more than half of all e-commerce payments worldwide by 2024.

Cashless Payments Today

Here are some of the cashless and contactless payment methods that are growing in popularity. You might already use some of these payments when you go to the store. Experts predict businesses will offer many of these payment methods moving forward.

Credit and Debit Cards

Credit and debit cards are one of the most frequently used cashless payment methods in the world right now. They are a quick, secure, and convenient method of payment.

But the use of banking cards has begun to decline in favor of mobile wallets and payment apps. In 2021, credit cards and debit cards accounted for 21% and 13% of global e-commerce payment methods, respectively. By 2025, the use of credit cards is expected to fall to 19%, while debit cards will remain stable at 13%.

If you own a business, this doesn’t mean you should completely forgo banking cards and start using mobile wallets instead. By 2025 (and beyond), many people will still rely on banking cards to make payments, especially now that banks are issuing cards enabled with Tap to Pay technology.

Savvy businesses accept both banking cards and mobile wallets as viable payment methods.

Mobile Wallets and Payment Apps

Mobile wallets, or digital wallets, are financial applications that run on mobile devices. These apps securely store your payment card information so that you can pay for items online or in-store without having to carry your cards around. All you need to initiate transactions is your smartphone/smartwatch and a good internet connection.

Examples of mobile wallets and payment apps include:

- Apple Pay

- Google Pay

- Samsung Pay

- PayPal

- Venmo

- CashApp

- AliPay

Digital wallets are extremely popular today, and you likely use them often. Ian Wright, the founder of Merchant Machine, believes that the popularity of mobile wallets will only grow in the future.

"Products like Apple Pay and Google Pay will certainly become more ubiquitous, which may give Apple and Google the opportunity to disrupt Visa and Mastercard," Wright says.

This is true. Data from FIS Global Payments Report 2022 shows that by 2025, mobile wallets will be used for 53% of e-commerce transactions worldwide — rising from 49% in 2021. For global point-of-sale (POS) transactions, the use of digital wallets is expected to rise from 29% in 2021 to 39% in 2025.

FIS found that people have started using digital wallets for payments more than they use their cards. E-wallets are expected to outgrow other POS payment methods and reach a 36.8% share — over $22.7 trillion.

Cryptocurrency

At this year's Super Bowl game, audiences were shown a clever 60-second ad from Coinbase, a platform for buying and selling cryptocurrency. This ad came in the form of a QR code that, when scanned, took people to Coinbase's website where they offered free Bitcoin worth $15 to new signups (for a limited time).

Not long after the ad aired, Coinbase's app crashed from the influx of traffic from the Super Bowl.

That goes to show just how mainstream cryptocurrency is — especially Bitcoin, which is the standard digital currency for mobile payments.

Bitcoin doesn't require extra fees or intermediaries to move from a consumer to a merchant. Apps like Coinbox implement a POS functionality to make the payment process easier for both businesses and customers.

Payment apps like PayPal have also started supporting crypto trading and payments on their apps. Major corporations like Microsoft and Expedia are also accepting crypto payments.

The crypto market is volatile, fluctuating frequently. This payment method may not be the best option for small-to-medium-sized businesses right now. But if the market stabilizes, it could very well be.

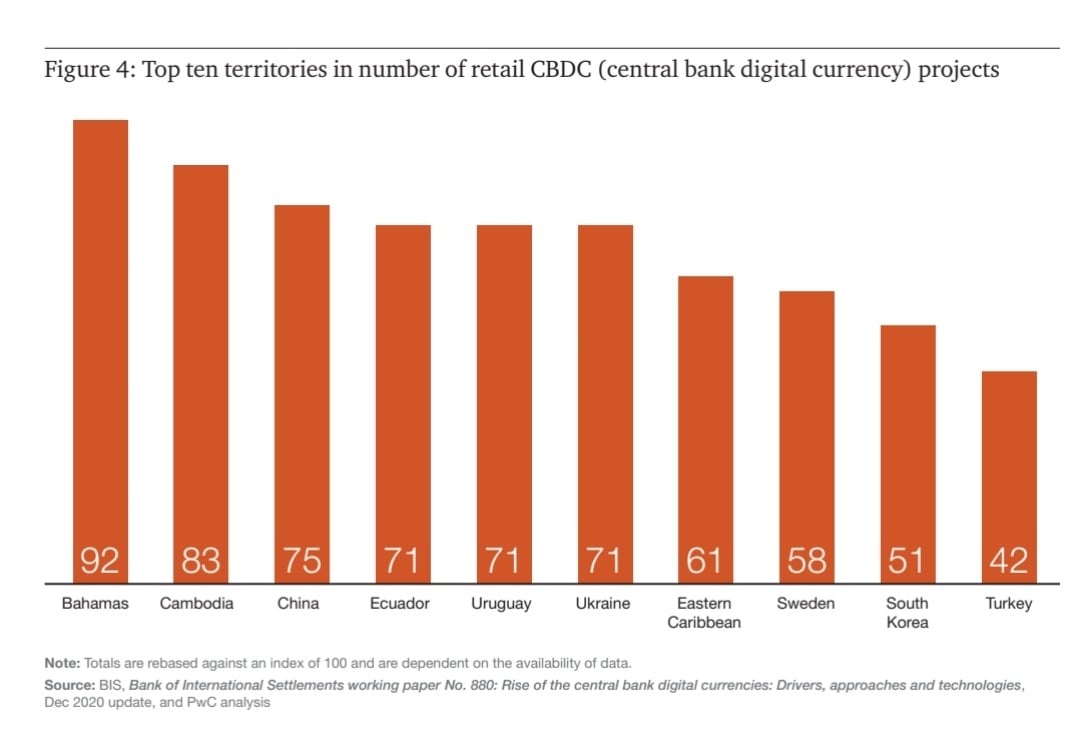

Central Bank Digital Currency

Central Bank Digital Currencies (CBDCs) are digital tokens issued by a country’s central bank to represent the virtual form of that country’s currency. This digital currency has the same value as fiat (physical) money.

The main goal of CBDCs is to offer privacy, financial security, accessibility, transferability, and convenience to businesses and consumers — especially those that have limited access to banks. CBDCs also aim to reduce the risks of using digital currencies (aka cryptocurrency) in their present, volatile form.

“If CBDCs are designed prudently, they can potentially offer more resilience, more safety, greater availability, and lower costs than private forms of digital money,” IMF Managing Director, Kristalina Georgieva, said in her 2022 speech at the Atlantic Council in Washington D.C.

“That is clearly the case when compared to unbacked crypto assets that are inherently volatile,” she says. “And even the better managed and regulated stablecoins may not be quite a match against a stable and well-designed central bank digital currency.”

Right now, ten countries and territories have launched CBDCs:

- Nigeria

- Jamaica

- Grenada

- The Bahamas

- Dominica

- Antigua and Barbuda

- Montserrat

- Saint Lucia

- St. Vincent and the Grenadines

- St. Kitts and Nevis

About 105 other countries, including the U.S. and the U.K., are still investigating CBDCs and how they affect existing financial networks.

QR Codes

Quick Response codes, or QR codes, are machine-readable barcodes that store information. This code consists of unique black and white pixels in a square-shaped grid.

To make payments via QR codes, a person has to scan the code displayed by the merchant with their mobile device. Then, users put in the amount they need to pay and submit.

Apple introduced QR code scanners in smartphones in 2017. Since then, most — if not all — other smartphone brands have incorporated them into their models. And now, QR code payments are one of the most efficient and popular cashless payment methods in the world.

The numbers reflect this. In 2020 during the pandemic, 1.5 billion people used QR codes to make a payment, according to Juniper Research. The firm also predicts that 30% of all mobile users will use QR codes by 2025.

This payment method is a secure alternative to cash transfers. Plus, businesses can process transactions without having to buy traditional payment hardware. All they have to do is set up QR codes that will take customers to their web payment form.

ACH Bank Transfers

An ACH transfer is an electronic payment made between bank accounts through the Automated Clearing House (ACH) network.

This payment method is one of the most popular types of bank transfers and is used for B2B direct deposit and automatic bill payments. In fact, 93% of Americans use ACH transfers to receive their salaries and pensions.

In 2021, the amount of money transferred through the ACH was over $8.89 trillion. That’s more than the amount transferred via checks and wire transfers.

All banks in the United States support ACH payments. Now, payment processors like PayPal, Stripe, and Square also support this payment method.

All that you need to make or receive an ACH payment is a working bank account and routing number. Transfers made through this route typically take 3-4 business days to complete

ACH payments have lower processing fees than credit cards. So if you have clients that pay you recurring fees or employees that you pay every month, ACH transfers are a great way to do that without incurring a loss. This is especially good for businesses in industries like legal, healthcare, education, property management, and subscription-based services.

Brick-and-mortar retail businesses shouldn’t use ACH payments for POS customer transactions. ACH transfers require a bank account and routing number and many shoppers don’t know their banking info off-hand.

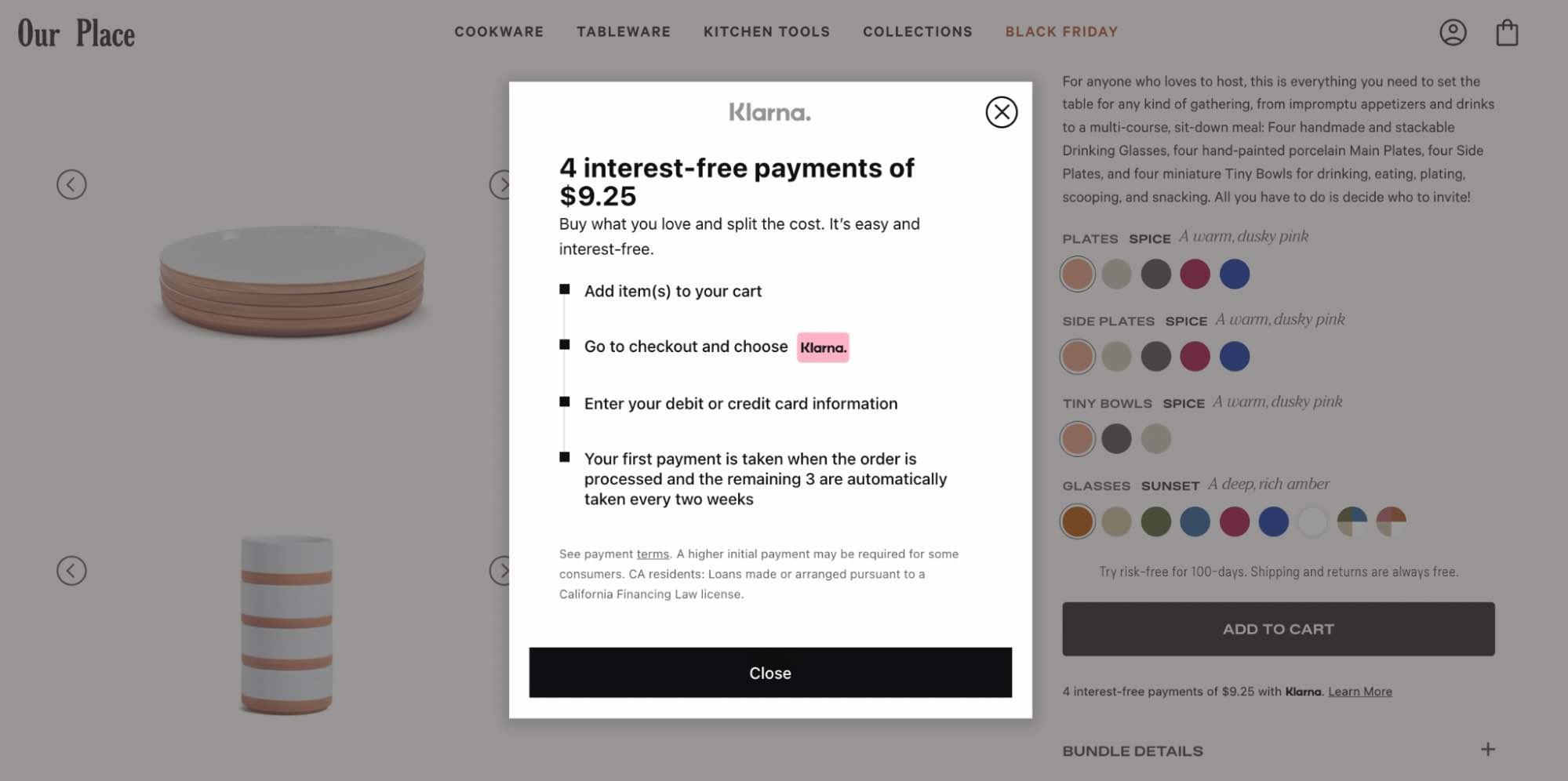

Buy Now, Pay Later

Buy Now, Pay Later (BNPL) is a payment method that allows customers to purchase expensive items on credit and pay in installments over time. It is a type of loan, except you don’t have to pay interest if you make your payments on time and in full.

The prospect of being able to make multiple interest-free payments over time can encourage shoppers to buy more, which results in more revenue for vendors. A study by McKinsey showed that 29% of BNPL users would have made a smaller buy or would not have bought at all if this payment option wasn’t available.

Banks like Chase and some credit card companies offer cardholders the opportunity to buy items and pay for them later. Apps like Afterpay (acquired by Square) and PayPal have also jumped on the bandwagon.

In 2021, BNPL accounted for 2.9% of global e-commerce transactions (a $157 billion value). Juniper’s research predicts that this value will grow 5.3% (or to $438 billion value) by 2025.

Companies that are already testing new cashless experiences

Amazon

In early 2020, e-commerce giant Amazon announced its new contactless payment technology, Amazon One. Here's how it works: Shoppers visit a point-of-sale station in certain locations to link their palms and payment cards to Amazon One. Once they've done that, all they have to do at future checkouts is hover their hand over a scanner to pay for their items.

The reasoning behind this is simple. Your palm is made up of tiny, mostly undetectable features that are unique to you. The Amazon One device, however, can read and recognize these features.

The device uses computer vision algorithms and proprietary imaging to capture and encipher an image of your palms. This way, it creates a unique palm signature that it can recognize every time you use the device.

As of September 2021, Amazon rolled out this new payment method to over 65 Whole Foods stores in California. This massive rollout certainly helps Amazon in its effort to modernize retail shopping and make it easier for customers to make payments.

Walmart

In December 2021, Walmart quietly filed several new trademarks that indicate that it plans to make and sell virtual items, including toys, electronics, self-care products, and home décor in the metaverse. Basically, Walmart wants to create its own cryptocurrency and non-fungible token (NFT) collections.

Fast forward to September 2022 and Walmart announced that they are launching two virtual experiences — Walmart Land and Walmart Universe of Play — in Roblox, a gaming platform.

These experiences will feature different games, a blimp that drops toys, a music festival with popular artists, and a store of virtual merchandise (known as "verch") that matches Walmart's physical and online inventory.

Walmart's Chief Marketing Officer, William White told CNBC that Roblox is presently a testing ground for Walmart as it considers operating in the metaverse and beyond. He also said that the way COVID-19 suddenly transformed people's shopping habits and online engagement prompted Walmart to start experimenting with new ways to reach shoppers — especially Gen Zs.

On revenue, White noted that Walmart won't make any money from these newly launched virtual experiences for now. But if things work out well, they could make money by partnering with other brands or by turning people's immersive experiences into real-life store visits or online purchases.

Albertsons

Yet another retail giant is experimenting with cashless payments. For Albertsons, it's AI-powered self-checkout carts.

These carts are made by Veeve, a company founded by two ex-Amazon engineers, and they aim to make in-person shopping smoother, especially in short-staffed stores. These carts use cameras and sensors to scan items that shoppers pick, compare products, and make personalized recommendations via a small on-cart screen. These carts also build 3D models of all the products in the store, so that it can recognize these items over time without the customer scanning them.

What's more, you don't need to check out when you use this cart. After shopping with Veeve carts, people can pay for their items by inserting or tapping their card without ever going to the checkout line.

In November 2021, Albertsons started testing these carts at two of its stores in California and Idaho. Now, they're expanding and adding the carts to more stores.

Apple

In June this year, Apple introduced the Tap to Pay technology on iPhones. According to Apple, this new tech will enable millions of US merchants — from solopreneurs to mega-retailers — to easily accept contactless credit and debit cards, Apple Pay, and other mobile wallets via a tap of an iPhone. No payment terminal or extra hardware needed.

After a person is done shopping, the merchant will tell the customer to hold their iPhone to pay with their contactless card, Apple Pay, or other digital wallet near the merchant's iPhone. With the tap of a button, the money moves from the customer to the merchant through near-field communication (NFC) technology.

Apple is partnering with payment apps like Square and Stripe to make the Tap to Pay on iPhone feature available on their platforms. This feature will only work with contactless credit and debit cards from popular payment networks, including Visa, MasterCard, American Express, and Discover.

Note: Tap to Pay feature only works on the Phone XS or newer. Older iPhone models don't support this feature.

In October this year, Google announced that it has partnered with Coinbase to accept cryptocurrency payments for its cloud services.

Both Google and Coinbase are looking to diversify their business models and expand their offerings. For Google, accepting crypto payments will give them access to fast-growth companies in the Web3 space. These companies would pay for Google's cloud services through Coinbase — a platform that trades ten different digital currencies, including Bitcoin, Ethereum, Litecoin, and Dogecoin.

As digital payments come in, Coinbase will take a cut of the fees, which will serve as a separate revenue stream that isn't directly related to retail trading fees.

How to Set Up Cashless Payments

With the increasing popularity of cashless payment methods, businesses that want to stay relevant in the future must set up flexible payment methods. Here are some ways you can prepare.

1. Consider the payment methods your customers prefer.

Not all businesses are the same. If you're a small business, there's a good chance you won't be able to use the same payment methods as large enterprises simply because it's not necessary.

The best way to know for sure which payment methods you should accept is by identifying your customers' payment preferences and implementing those options.

For example, if your customers like using their cards to pay, set up a POS terminal. If many of your customers have contactless payment cards or use iPhones a lot, you can accept payments via the Tap to Pay technology. But if they don't carry cards at all, there are other options you can offer, like digital wallets or QR codes.

An important thing to consider is that your customers' payment preferences may vary by age, location, and other demographic factors. So it's best to offer different payment options so that you cater to all your customers' needs.

2. Use a payment processor.

To accept debit card and credit card payments, digital wallet payments, and ACH transfers, businesses must partner with a payment processor that complies with Payment Card Industry (PCI) standards. Payment processors are third-party vendors (or apps) that manage financial transactions by mediating between the merchant and customers involved.

These apps ensure that a customer has enough funds to pay for an item and securely move the money from the customer's account to the merchant's in the blink of an eye.

Popular payment processors include:

- Square

- Clover

- Stripe

- Stax

- Payment Depot

- PayPal

- Payoneer

In addition to payment processing, some of these apps offer merchant accounts and payment gateways.

When choosing the right payment processor for your business, look out for the following:

- The kind of payments the processor accepts.

- The fees the processor charges per transaction.

- What platform transactions can take place.

3. Offer Buy Now, Pay Later.

It's been proven that retailers that offer a Buy Now, Pay Later (BNPL) option to their customers are likely to get more sales.

Between 2020 and 2021, the rate of American consumers using the BNPL payment option increased by 80%. Of those users, 40% were millennials, and Gen Z consumers are quickly catching up. So if you're trying to expand your customer base to include younger people, BNPL can help you get there.

This payment method works exceptionally well for e-commerce stores to reach new customers, get more conversions, and increase average order value (AOV).

Some reliable BNPL providers include:

- Affirm

- AfterPay

- Klarna

- Stripe

4. Install a commerce-powered CRM.

Picture this: You have a customer who's waiting for you to send an invoice to their mailbox before they can mail you back a check for an item they bought. As they waited for your invoice, they decided to do a trial buy of the same item from your competitor. Because your competitor offers the Tap to Pay option, the customer was able to pay for the item in a few seconds.

Which company do you think the customer would want to work with next time: you or the competitor?

To prevent a situation like this, use a CRM platform with payment gateway integration. HubSpot is a great example of this.

Inside the HubSpot CRM is a native payments tool that streamlines your entire sales process so that you can get paid early, take on more customers/clients, and grow your business. HubSpot's payments tool allows you to send your customers quotes or payment links, after which they pay you. No need for paper checks.

If the payments are recurring — like online subscriptions — you can simply automate the process instead of sending quotes to customers every month. HubSpot payments tool also gives your customers the flexibility to make transactions whenever and however they want on the CRM.

This greatly boosts your customer experience and helps you maintain your relationship with your customers long-term.

Adopt Cashless Payment Methods

The increased use of cashless payments has revolutionized the way people do business around the world. From grocery stores to restaurants and online stores, many businesses now offer cashless transactions.

If you want your business to stay afloat during this change, you need to start accepting a variety of cashless payment methods. This way, your customers are not limited in their options, and you can collect payments speedily and securely.