Planning for your company's future is significantly easier and more effective when you have a picture of what that future might look like. That's why any business interested in sound financial planning needs to have a grip on financial forecasting — the process of making accurate projections that can frame thoughtful, productive financial decisions in real time.

Here, we'll explore the concept of financial forecasting in depth, review some popular financial forecasting models, go over some prominent financial forecasting methods, and see some of the best financial forecasting software solutions on the market.

1. What is financial forecasting?

2. Financial Forecasting Models

- Top-Down Financial Forecasting

- Delphi Financial Forecasting

- Statistical Forecasting

- Bottom-Up Financial Forecasting

3. Financial Forecasting Methods

-

Straight Line

Simple Linear Regression

Multiple Linear Regression

Moving Average

4. Financial Forecasting Software

What is financial forecasting?

Financial forecasting is a process where a business leverages its current and past financial information to project its future financial performance. Forecasts are typically applied to assist with budgeting, financial modeling, and other key financial planning activities.

Financial forecasting is often conflated with the other key financial planning processes it generally informs — namely, budgeting. Though the two activities are often closely linked, it's important to differentiate between them.

Forecasting vs. Budgeting

The difference between a financial forecast and a budget boils down to the distinction between expectations and goals. A forecast details what a business can realistically expect to achieve over a given period.

When done correctly, it represents a reasonable estimate of how a company will likely perform — based on current and historical financial data, broader economic trends, foreseeable factors that might impact performance, and other variables that can be viably accounted for.

A budget, on the other hand, is the byproduct of a financial analysis rooted in what a business would like to achieve. It's typically updated once per year and is ultimately compared to the actual results a business sees to gauge the company's overall performance.

Now that we have a picture of what financial forecasting is, let's take a look at some of its most popular models.

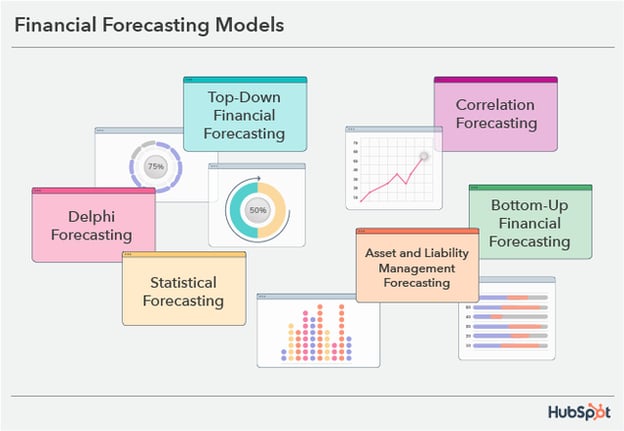

Financial Forecasting Models

1. Top-Down Financial Forecasting

Top-down forecasting is a financial forecasting model where a company starts by analyzing broader market data and ultimately whittles down company-specific revenue projections from there.

It's one of the more simple, straightforward forecasting models — essentially amounting to a company looking at its total market size and calculating potential revenue based on its assumed market share.

Top-Down Financial Forecasting Example

Let's say a company occupies space in a market that generates an estimated $1,000,000,000 in revenue annually. If the business assumes it will have a market share of 2.5%, a top-down forecast would suggest that it will see $25,000,000 in revenue in the coming year.

Benefits of Top-Down Forecasting

- It provides a more streamlined approach for larger, established businesses with diverse revenue sources than a concentrated, product-level forecast.

- It's often the only viable forecasting avenue for early-stage companies without extensive financial data.

Drawbacks of Top-Down Forecasting

- It's often seen as hastier and more superficial than more granular forecasting methods.

- A top-down forecast is generally seen more as a starting point than a concrete projection.

2. Delphi Forecasting

The term "Delphi" here is a reference to the ancient Greek city where the Greeks consulted the mythical oracle Pythia. Fittingly, the Delphi forecasting method involves financial forecasters consulting experts for their takes on projections.

With this method, a business sends multiple rounds of questionnaires to a panel of experts, covering the company's financial data. With each new round, the experts see an aggregated summary of the previous round and adjust their perspectives accordingly. Ultimately, the hope is that a few rounds can produce a consensus among the experts that can be applied to the company's financial projections.

Delphi Financial Forecasting Example

If a company were to leverage the Delphi model, it would gather a diverse array of experts and send them questionnaires without any of them ever meeting face-to-face. After one round, the experts would each receive a summary, detailing what the other experts thought with respect to the business's potential financial performance.

The experts would be at least partially moved by the group response and submit a new questionnaire accordingly. The panel would continue to receive questionnaires until it arrived at a consensus, and the forecast would be based on that insight.

Benefits of Delphi Forecasting

- It tends to be more objective than conventional, in-house forecasting.

- Contributions are anonymous, so respondents can answer candidly.

Drawbacks of Delphi Forecasting

- The method doesn't allow for a productive, open dialogue like a face-to-face meeting would.

- Response times can be long or unpredictable, prolonging forecast delivery.

3. Statistical Forecasting

Statistical forecasting is a broad term that accounts for a variety of forecasting methods. At its core, the model is exactly what it sounds like — forecasting based on statistics. More specifically, the term is essentially a catch-all that covers forecasting rooted in the use of statistics derived from historical, quantitative data.

Statistical Financial Forecasting Example

One method that generally falls under the statistical financial forecasting umbrella is the moving average method listed below. A company might look at the revenue it generated over the past 100 days and apply that statistic to its potential performance over the next similar period.

Benefits of Statistical Forecasting

- It rests on a more solid basis than other methods.

- It can be more straightforward than other methods — provided you have the right data.

Drawbacks of Statistical Forecasting

- Certain methods that fall under this umbrella can provide relatively hasty estimates, relative to other models.

- Companies without extensive historical data might not be able to produce reliable statistical forecasts.

4. Bottom-Up Financial Forecasting

As you can probably assume, bottom-up financial forecasting is essentially the opposite of top-down forecasting — it's a model where a company starts by referencing its detailed, ground-level customer or product information and works its way up to a broader revenue projection.

Bottom-Up Financial Forecasting Example

A bottom-up financial forecast could start with a business taking a look at its sales volume — or the total number of units of its product it moved in a given period — from the previous year. Then, it would estimate the price it expects to charge for that product in the coming year. From there, it would calculate its projected revenue by multiplying the two figures.

Obviously, that example is unrealistically straightforward. In most cases, the business in question here would consider other lower-level variables as well — potentially including customer-related information like total customers or retention rate.

Benefits of Bottom-Up Forecasting

- The model allows for more detailed analysis than most others.

- It offers more room for input from various departments.

Drawbacks of Bottom-Up Forecasting

- Any errors made at the micro-level can be amplified to the macro-level with this model.

- A thorough bottom-up forecast can be time-consuming and particularly labor-intensive.

Financial Forecasting Methods

1. Straight Line

True to its name, straight line forecasting is probably the most straightforward financial forecasting method businesses can leverage. It's rooted in basic math and tends to provide rougher projections than the other, more sophisticated methods listed here.

With straight line forecasting, a business gathers rough growth estimates — typically pulled from past figures — and applies them to coming months, quarters, or years. It's generally employed when a company assumes it will see steady growth over a given period.

For instance, if your business has seen revenue reliably grow 5% year over year for the past four years, you might use that figure to guide your straight line forecasting and assume that level of growth will continue for the next few years.

2. Simple Linear Regression

The simple linear regression is a common financial forecasting method where a business explores the relationship between two variables — one independent and one dependent. For instance, a company could use this method to forecast revenue by gauging how it might be impacted by shifts in GDP.

3. Multiple Linear Regression

Simple linear regression analysis often isn't enough to make accurate financial projections, as financial performance is rarely a function of a single factor. The nature of the multiple linear regression is covered by its name — instead of trying to predict how financial performance will play out in response to a single variable, the model considers two or more independent factors.

4. Moving Average

Moving average forecasting is a method most commonly used to identify the trend-direction of a stock, but businesses can still leverage it to project their financial performance. It involves taking the arithmetic mean of a dataset from a past period and applying that average to future projections. The method is typically used to evaluate potential performance over shorter periods — like weeks, months, or quarters.

Financial Forecasting Software

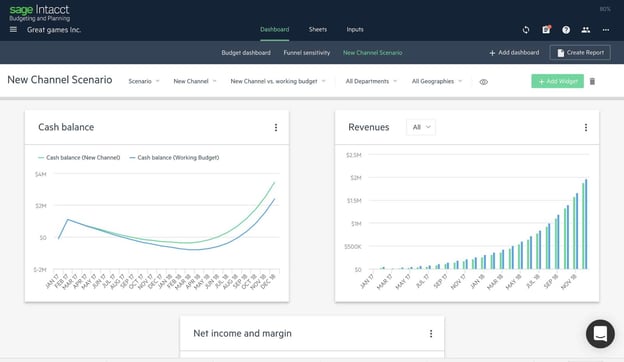

1. Sage Intacct

Pricing: Contact for Pricing

Sage Intacct is a multifaceted accounting and financial planning software with an accessible interface and a suite of features that can streamline your financial forecasting time by over 50%. The platform's automated forecasting resources effectively eliminate the stress, legwork, and room for error that often come with financial planning via spreadsheets.

Best for Collaboration

Sage Intacct separates itself from similar applications through its accessibility and room for collaboration. The software is particularly user-friendly and offers a singular, centralized solution for virtually any stakeholder within an organization to easily contribute to and make sense of financial projections.

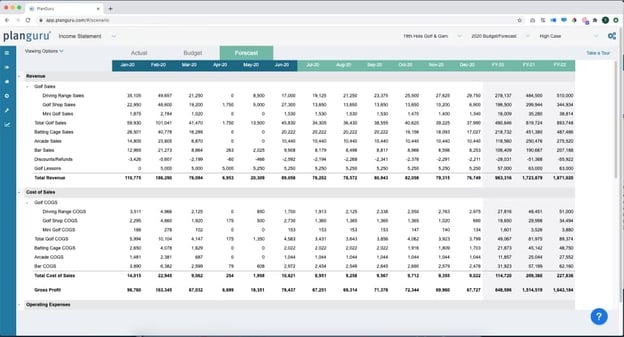

2. PlanGuru

Pricing: Plans Starting at $99 per Month

PlanGuru is a dedicated financial forecasting software — supporting 20 separate forecasting methods that can cover projections of up to 10 years. The program also allows you to incorporate non-financial data into your forecasts and has scenario analysis features to help you interpret the ramifications of potentially impactful events. PlanGuru also offers a range of plans to suit most SMBs' budgets.

Best for Pure Financial Forecasting

Some of the other resources listed here are multifaceted accounting solutions that happen to cover financial forecasting — not PlanGuru. This application is primarily dedicated to creating financial projections.

As I mentioned, it offers 20 unique financial forecasting methods to support more effective strategic planning — along with a host of other features tailored to help you gauge your future financial performance. If you're interested in a cost-effective, forecasting-specific platform, look into PlanGuru.

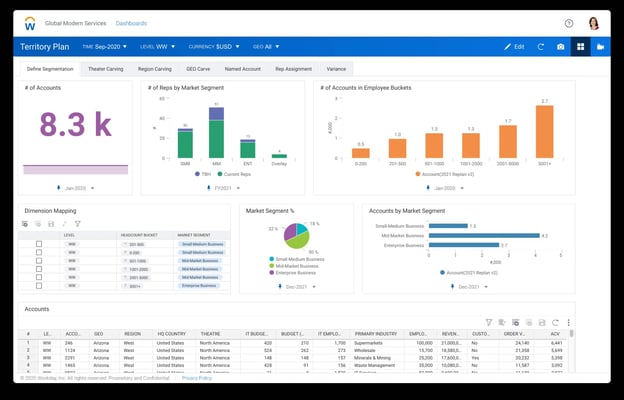

3. Workday Adaptive Planning

Pricing: Contact for Pricing

Workday Adaptive Planning provides financial forecasting resources that reconcile accessibility with powerful functionality. The software lets you leverage both real-time financial and operational data to create and compare multiple accurate, effective what-if scenario models. It also allows you to forecast across any time horizon — whether it be daily, monthly, quarterly, or long-term.

Best for a Dynamic Range of Forecasting Options

Workday Adaptive Planning's ability to support detailed bottom-up and top-down forecasts makes it a particularly attractive option for businesses of virtually any size. It allows you to create compelling forecasts based on targets from executive guidance or ground-level operational plans.

That dynamic range of forecasting options helps set the program apart from similar options. If you're interested in software that lets you forecast from various perspectives without sacrificing accuracy or effectiveness, look into Workday Adaptive Planning.

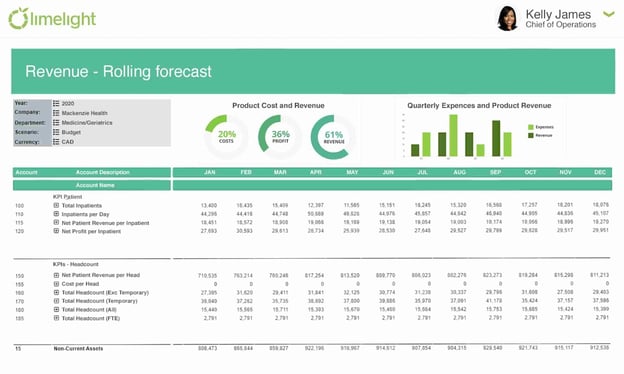

4. Limelight

Pricing: Contact for Pricing

Limelight is an integrated, web-based financial planning that provides businesses with a centralized solution for almost all of their forecasting needs. Designed primarily to suit finance and accounting teams, the software offers powerful general automation and automated data integration to streamline and simplify forecasting without losing out on quality.

Best for a Familiar, Excel-Esque UX

Limelight's user experience is designed to reflect Excel — making it a familiar, particularly easy option for CFOs, controllers, budget managers, and other users to adapt to. If you're interested in a powerful forecasting resource with that kind of accessibility, Limelight might be your best option.

Forecasting is a central component of sound, productive financial planning. If you have no idea what to expect financially, you'll have a hard time preparing for obstacles, setting attainable goals, and identifying aspects of your business that should be of particular interest. No matter the scale or nature of your organization, having a pulse on your financial future is always in your best interest.

Entrepreneurship

.jpg)

![7 Ways to Recession-Proof Your Business [+9 Recession-Proof Business Ideas]](https://2406023.fs1.hubspotusercontent-na1.net/hubfs/2406023/Imported_Blog_Media/Recession%20Proof%20(1).jpg)

![Target Markets: Why They Aren't Just for Marketers [A Quick Guide]](https://2406023.fs1.hubspotusercontent-na1.net/hubfs/2406023/Imported_Blog_Media/Target%20Market.jpg)

.jpg)