There’s so much freedom that comes with being self-employed. You make your own schedule, choose which clients you want to work with (or avoid), decide what you’ll charge, and determine how much you’d like to make. Of course, there are also quite a few responsibilities that you may never have had to take on in the past.

One of these tasks is preparing for your taxes. Sure, you’ve (hopefully) been paying taxes this entire time — but you’ve probably never had to consider business expenses that qualify as deductions. For new business owners, this can be rather daunting. If you’ve ever walked into your accountant’s office with a shoebox overflowing with receipts, you aren’t alone.

The great news is that there are business expense trackers availablemake your and your accountant’s lives easier — ensuring that everything you purchase during the year to assist in building and operating your business is taken into consideration when it’s time to pay your taxes. Let's take a look at six of the best ones on the market.

Business Expense Trackers

Imagine uploading your business expenses the moment you spend the money, then not having to think about them again until you need to see how much you’ve spent.

No stress, no ripping your desk or car apart on looking for a receipt from nine months earlier, and no panic if you're ever audited and forced to provide proof of your deductions. On top of that, imagine knowing exactly where your money goes each month so you can create a better budget for your business.

While this may sound like a fantasy world, with the right tools, you can easily make this your reality. A business expense tracker will help you keep an accurate record of your expenses using receipts, invoices, and any other outgoing expenses that impact your budget.

The Best Business Expense Trackers

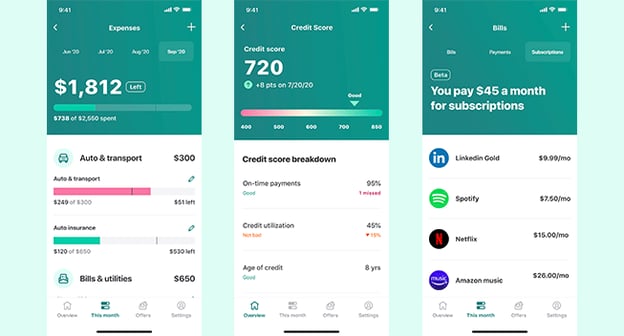

1. Mint by Intuit

Pricing: Free Plans Available

Did someone say "free?" When you’re first starting out, the thought of adding another monthly expense (even though you’ll be deducting it later) is painful. Thankfully, Mint offers a free platform for both personal expense tracking and business expense tracking.

It provides an easy-to-read dashboard so you can catch a glimpse of your overall situation at any time. One drawback with the software is that there's no feature for uploading your receipts — expenses must be input manually.

Mint's Key Features and Benefits

- You can monitor your credit.

- You can connect your accounts so you can categorize your transactions.

- You can track investments.

- You can create and work towards savings goals.

- You can pay bills on time with "payment due" notifications.

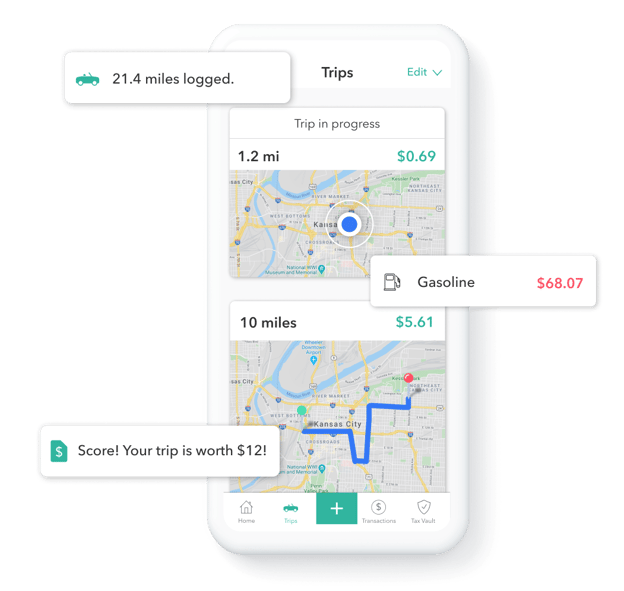

2. Everlance

Pricing: Free Plans Available, Premium Options Starting at $118 per User per Year.

For those self-employed individuals who spend most of their time in their cars, Everlance is a great option. The developers of this app understand the frustrations behind tracking mileage and set out to create the perfect system for logging and reporting business driving.

Everlance's Key Features and Benefits

- GPS helps create an IRS-compliant mileage log (you can turn this off if you’d rather manually track).

- You can sync the app with your bank and credit card to log expenses and receipts.

- You’ll receive mileage and expense reports in multiple, IRS-compliant formats (PDF, CSV, Excel).

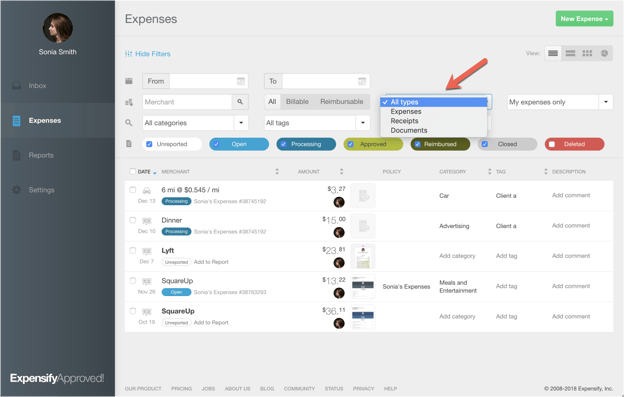

3. Expensify

Pricing: Free for up to 25 Scans per Month, Paid Options Starting at $5 per Month

For those who find themselves traveling a great deal for work, and often return home with a wallet full of receipts, Expensify can take (some of) the stress out of travel.

The app was designed to manage receipts and expenses. It also works well for teams — as receipts can be submitted directly to a manager or accountant. They can then approve or reject the expense from the app. Expensify offers next-day reimbursement as well as a corporate Visa card and a corporate travel assist.

Expensify Key Features and Benefit

- You can easily snap photos of your receipts.

- You can categorize, tag, and group expenses into an easy-to-read report.

- You can use GPS to track mileage.

- You can automatically import receipts from Uber, Airbnb, and several other popular travel sites.

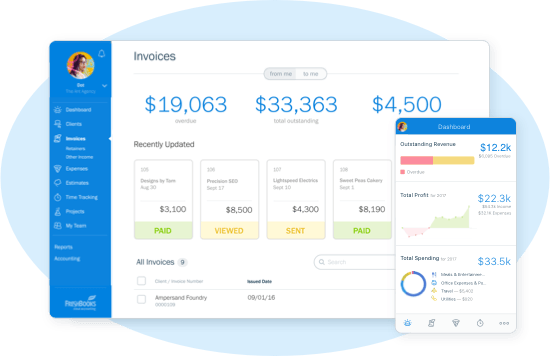

4. FreshBooks

Pricing: Plans Starting at $6 per Month

If the thought of death-by-spreadsheet terrifies you, FreshBooks may be just what you need. The app will sync with your bank account each day and pull in any expenses. From there, you can upload photos of your receipts and reconcile all charges.

FreshBooks' Key Features and Benefits

- You can easily input expenses on your phone or computer.

- You can send professional invoices.

- You can create automatic payment reminders.

- You can accept online payments.

- You can automatically track mileage.

- You can submit estimates and proposals.

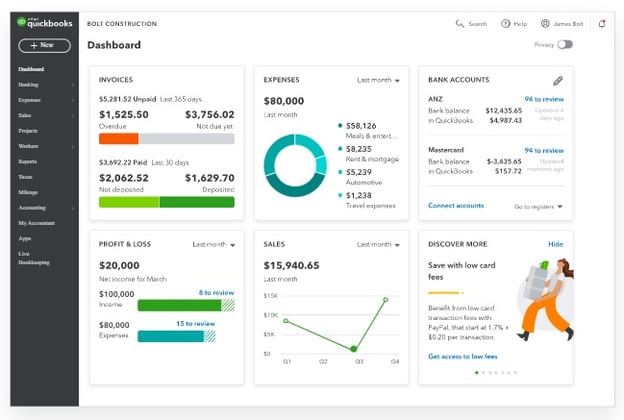

5. Quickbooks by Intuit

Pricing: Plans Starting at $25 per Month

For those who need their business expense tracker to perform a wide range of duties, Quickbooks is an excellent option. This is a much more robust system than the other options listed here — it also requires more time, knowledge, and effort to use.

You'll need to either devote some time to learning the system and setting it up to meet your specific needs or have an employee or contractor whose sole responsibility is handling the system.

Quickbooks' Key Features and Benefits

- You can automatically track mileage.

- You can snap pictures of receipts to easily upload.

- You can send and track invoices (in multiple currencies).

- You can link your bank and credit card accounts.

- You can track employees’ time and run payroll.

- You can integrate with more than 80 apps including inventory management and advanced CRM.

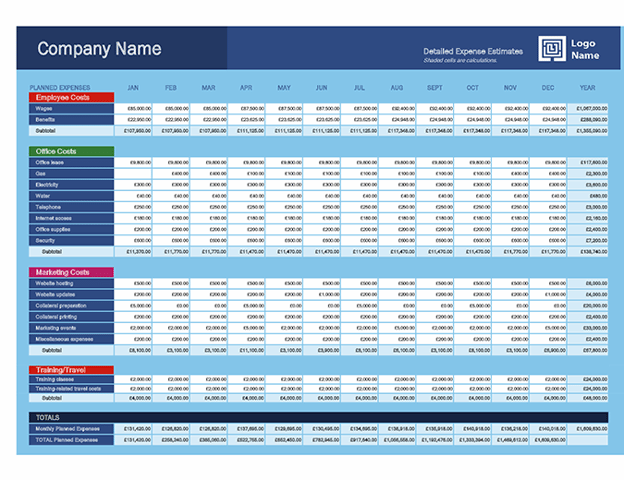

6. Excel Spreadsheets

The last system we’ll look at is probably the simplest. An excel spreadsheet is a no-frills way to keep track of your business expenses. With a business expense tracker template, you’ll be on your way to easier bookkeeping in no time.

While you can generate reports for your business, keep in mind that this option does not provide for receipt uploads, automatic mileage tracking, a mobile app, or many other features you’ll get with the other options discussed above. Of course, it’s free and easy, which may be more important to you at this stage of your business.

Business Expense Tracking Best Practices

No matter which option you decide is best for your budget and your business, there are a few best practices that will help create a seamless process for tracking your business expenses.

- Upload your receipts. Whether you use an app with this option built-in or purchase a separate receipt scanner, having receipts for all your purchases in digital form, will save you a lot of time come tax season.

- Keep your personal and business transactions separate. Opening a business credit card and a business checking account will make classifying these purchases much easier. You’ll also see potential benefits like rewards from your business credit cards. Depending on how your business is set up, you may be required by law to keep personal and business expenses separate.

- Don’t just set it and forget it. While automating your business expense tracking is designed to save you money, you still have to be aware of what you’re spending. Review expenses weekly to determine if you are staying on budget and if there are any areas you’re spending money — but don’t need to be.

If you’re like most entrepreneurs, you went into business for yourself to have more freedom, make more money, and do what it is you love to do — which probably isn’t bookkeeping. With a business expense tracker, you can take some of the anxiety out of budgeting, and avoid the tax-time panic when you rush to gather everything you need.

Find the best business expense tracker for your business and make your life a little bit easier.

Accounting

![The Plain-English Guide to Revenue Run Rate [Infographic]](https://2406023.fs1.hubspotusercontent-na1.net/hubfs/2406023/Imported_Blog_Media/run-rate.jpg)

.jpg)

![Work Orders: What They Are & What They Look Like [Template]](https://2406023.fs1.hubspotusercontent-na1.net/hubfs/2406023/Imported_Blog_Media/Work%20Order%20(1).jpg)

![What's an Expense Report? [Why It Matters + Template]](https://2406023.fs1.hubspotusercontent-na1.net/hubfs/2406023/Imported_Blog_Media/expense-reports-fi%20(1).jpg)