Your B2B pricing plays a key role in shaping your company’s revenue. Set your pricing too low and you’ll need to capture an enormous size of your total addressable market to hit your goals. Go too high and you alienate customers on smaller budgets. Hide your pricing so you can sell to any type of customer, and people may lash out.

When selling in B2B, you’ll need to set the best prices to guarantee customer acquisition and retention. This may seem complicated at first glance, but it doesn’t need to be.

In this post, you’ll learn:

- What is B2B Pricing?

- Four B2B Pricing Models (Including Their Pros and Cons)

- Four B2B Pricing Strategies (Including Their Pros and Cons)

- Three B2B Pricing Mistakes to Avoid Like a Plague

What is B2B pricing?

B2B pricing involves setting the costs of products sold by one business to another business. These businesses could be startups that serve SMBs or enterprise companies that sell to the Fortune 500.

It’s important to be mindful of the different pricing models, strategies, tips, and mistakes to avoid when establishing your B2B prices. We’ll discuss each of these below.

B2B Pricing Models (With Pros and Cons)

A B2B pricing model is the framework and structure for your pricing strategy. It determines how you’ll charge other businesses when they make a purchase. For example, while some businesses charge by usage amount, others charge a flat rate or use tiered pricing.

Here are four of the most popular B2B pricing models.

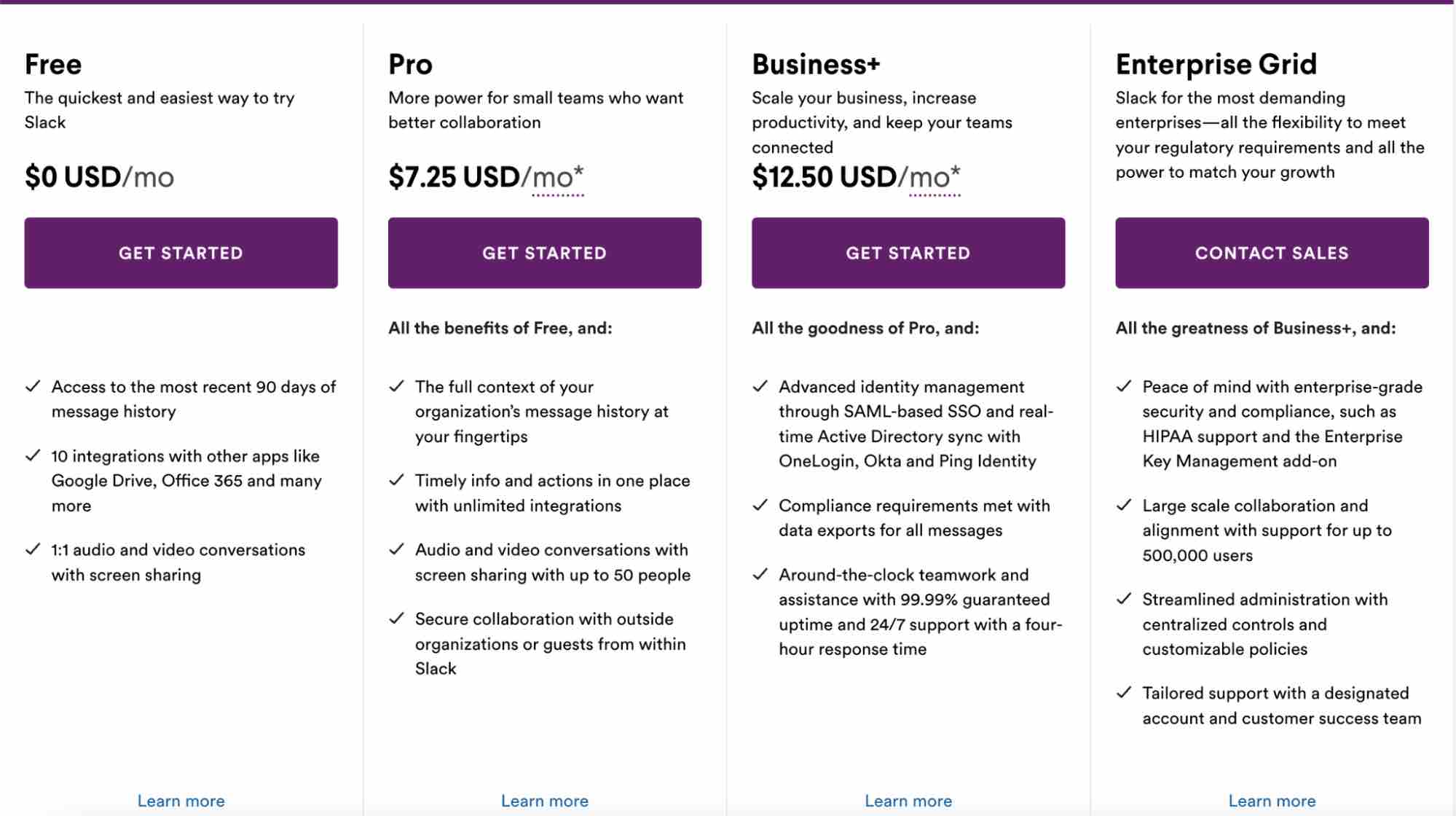

1. User-Based Pricing

User-based pricing charges businesses based on the number of users who will have access to or use your product. Prices are higher if there are more users, and lower if there are fewer.

For instance, Slack charges per user.

| Pros of User-Based Pricing |

Cons of User-Based Pricing |

| This is a straightforward, simple model for selling. |

Buying companies may share a single login for multiple users to avoid higher costs. |

| Buyers understand what they’re paying for upfront, so there may be less time between discovery and purchase. |

You may lose valuable revenue that comes from selling by the value you provide. |

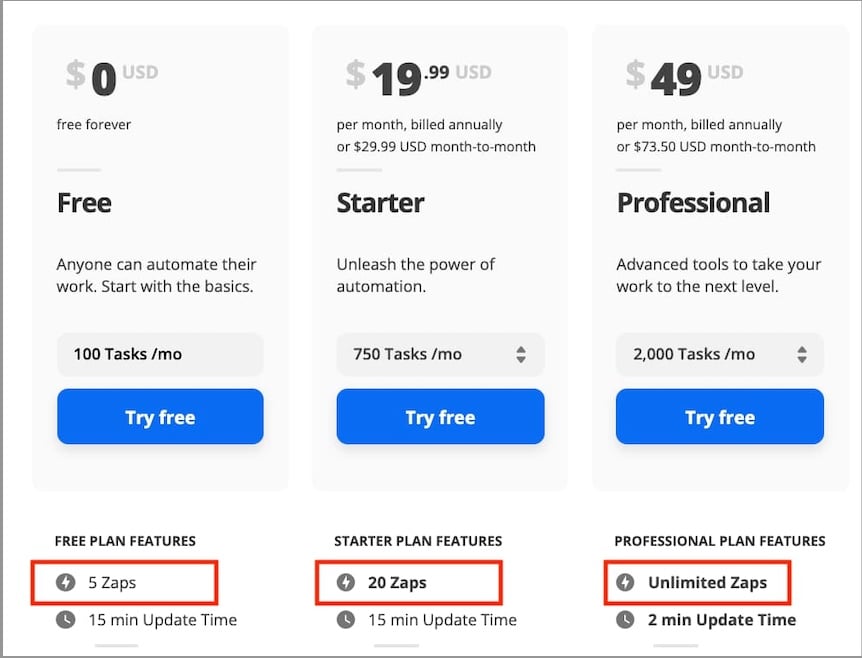

2. Usage-Based Pricing

Usage-based pricing charges businesses based on how much they use your product, so more usage means higher costs. This allows purchasing businesses to remain in control of how much they spend, as they know what the costs will be.

Zapier is an example of a business that runs on usage-based pricing. The company charges customers based on the number of Zaps and tasks they run per month. Here’s how their pricing looks.

| Pros of Usage-Based Pricing |

Cons of Usage-Based Pricing |

| This model appeals to purchasing businesses because they can anticipate costs. |

Customers may become frustrated if monthly usage changes and bills vary. |

| Customers pay more when they need your product or service the most, so you may experience revenue spikes. |

Businesses may use your product less during specific periods, causing revenue disparity and an inability to do accurate sales forecasts. |

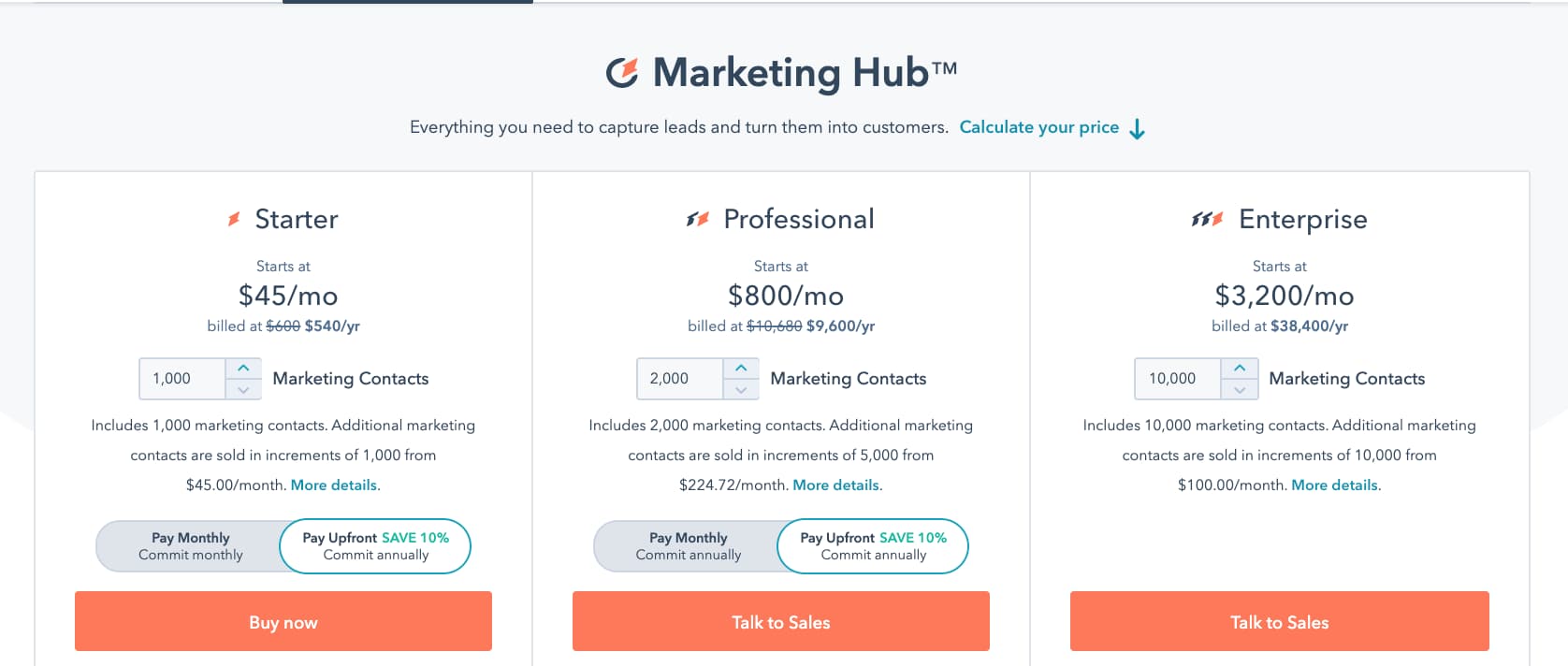

3. Tiered Pricing

Tiered pricing sells your product at different price points depending on the features included at each level. The lowest cost typically comprises the least amount of features, while the highest includes the most.

HubSpot uses a tiered pricing strategy, as shown below.

Businesses often combine this model with a value-based pricing strategy. If you have product features that are more valuable than others and cost more to produce, you can ensure you charge the correct amounts.

| Pros of Tiered Pricing |

Cons of Tiered Pricing |

| You can adequately price features that took more time to create or provide more value by placing them in higher tiers. |

It's challenging to select the features to include in each tier. |

| Customers can choose the plan that works best for them, so you can attract qualified businesses for each tier. |

Going overboard by creating more than three tiers can cause cognitive overload, making it difficult for prospects to decide on a suitable tier. |

| Upselling is attractive to the purchasing businesses because they may scale and desire additional features. |

You can’t collect extra revenue if users of your top-most tier exceed their service usage. |

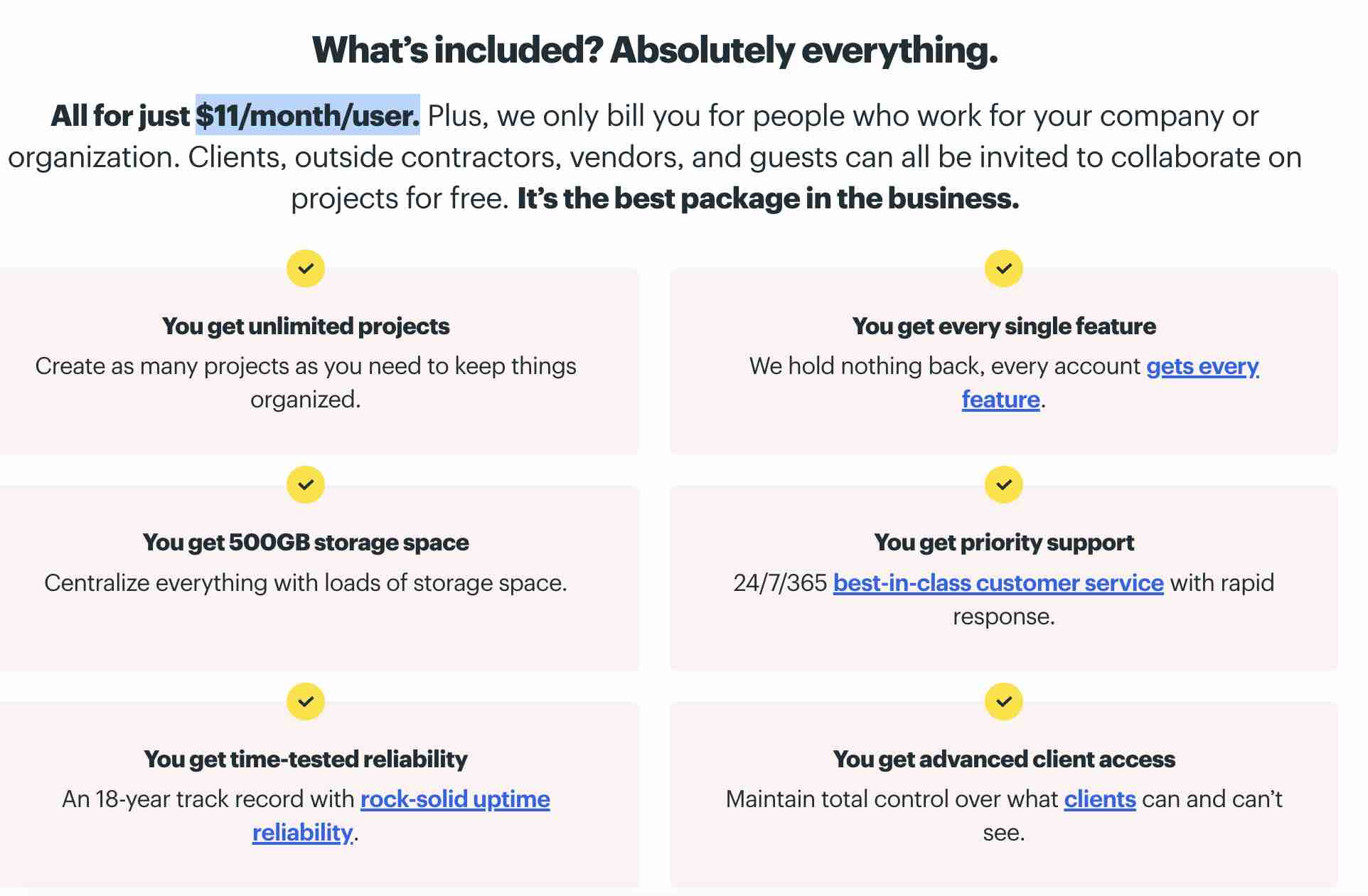

4. Flat Rate Pricing

Flat rate pricing means you offer one product and include all features at one price. Basecamp, a project management tool, uses the flat rate pricing model.

Once you’ve selected the model that works best for you, it’s time to pick a pricing strategy that will allow you to maximize profits.

B2B Pricing Strategies (Including Their Pros and Cons)

Before adopting any B2B pricing strategy, you need to consider your goals.

If you’re new in the market, it may be plausible to price your product for unlimited users. But after you’ve nailed your brand awareness, you may want to switch to per-user pricing. With your goal figured out, you can easily decide how to price your products using any of these strategies.

1. Value-Based Pricing

Value-based pricingis an excellent way to assess the perceived value of your product versus what customers are willing to pay for your product. Patrick Campbell, Founder and CEO of ProfitWell puts this another way, “Your price is an exchange rate on the value you’re providing.”

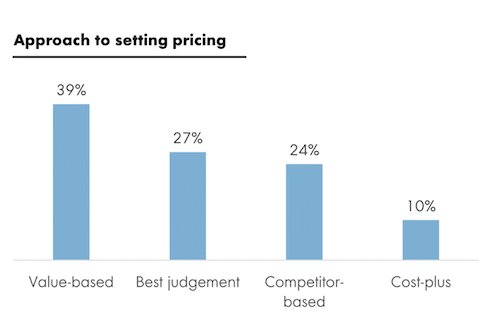

In 2021, 39% of B2B SaaS companies set their product’s cost using value-based pricing.

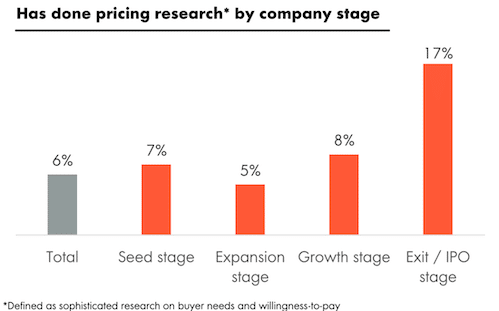

If you opt for this pricing model, you’ll need to do your homework. Talking to customers can help you determine how much they are willing to pay and where they find the most value in your offering. Plus, you have an advantage. Many companies skip this important step.

Talking to your customers helps you understand how users feel about your product. With this insight, you can set a value-based price that’ll help you grow your revenue and keep customers excited about using your product.

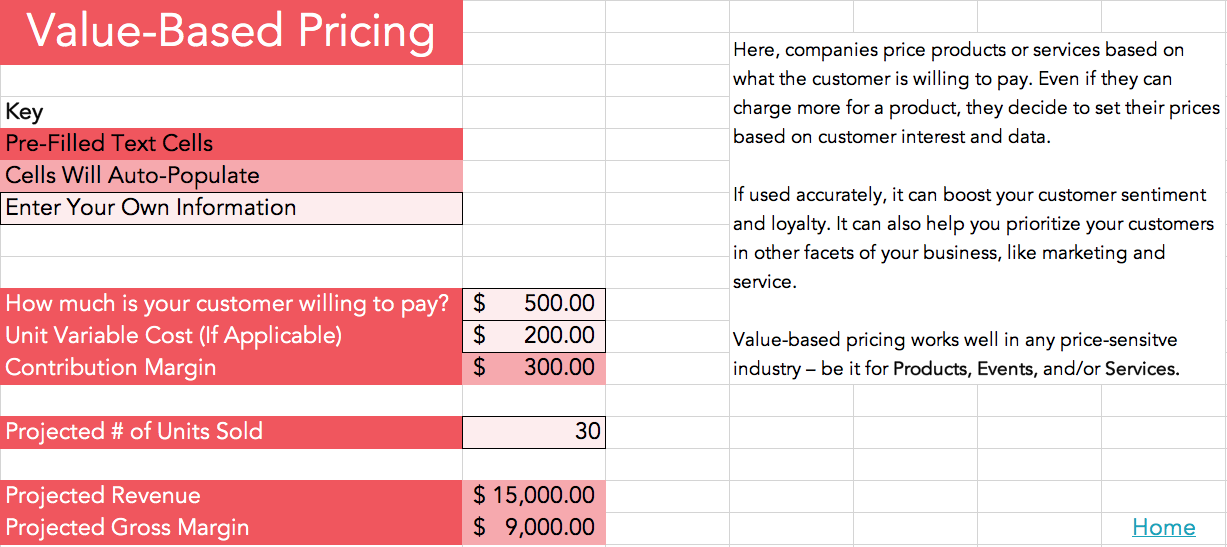

Pro tip: Plug feedback and numbers from customers into a pricing calculator. This spreadsheet will help you stay organized as you calculate pricing.

Featured Resource: Value-Based Pricing Calculator

Download this Template for Free

| Pros of Value-Based Pricing |

Cons of Value-Based Pricing |

| It’s easy to be competitive in your industry because you charge based on your customers. |

Calculating value can be difficult, as it requires significant time to understand your target audience and gather business data. |

2. Cost-Plus Pricing

Cost-plus pricing (also called markup pricing) is a pricing strategy where you add a fixed percentage of production costs to a unit of what you sell. For example, if you break down your product's costs and discover the cost of development is $15, labor is $30, and miscellaneous is $10, adding a 25% markup means your cost-plus price is $68.75.

This strategy is easy to implement as it focuses less on consumer demands and competitor pricing. However, only 10% of B2B companies use this strategy. However, this model may lead you to over-price a product in a weak market and under-price in a strong market. Assess the market price for similar products before opting for cost-plus pricing.

| Pros of Cost-Plus Pricing |

Cons of Cost-Plus Pricing |

| This model is simple to calculate. |

You may overprice your products and lose out on sales if prices are too high. |

| This is a transparent strategy, as buyers understand what goes into your pricing. |

SaaS businesses may miss out on profits because the value of your product may outweigh its production costs. |

3. Competitor-Based Pricing

Competitor-based pricing centers on using the going market rate for similar products and charging below, at, or above the industry rate. If you run a relatively new B2B company, you can use this strategy because existing brands have already assessed what customers want to pay for a product like yours.

To use this strategy, you can generate a list of your competitors from popular review platforms like G2, GetApp, and SourceForge. Afterward, check out their prices and decide on a price point for your product.

| Pros of Competitor-Based Pricing |

Cons of Competitor-Based Pricing |

| Competitor-based pricing requires quick research into your competitors’ pricing strategies. |

If your products become extremely popular, you may lose revenue by sticking to this pricing strategy. |

| Basing prices on the going market rate helps customers understand what to expect and your prices won’t scare them away. |

This method does not consider production costs. Meaning, you may put more effort into creating your product but generate minimal revenue. |

| You can adjust prices based on the market; if your competitors change, so can you. |

This strategy may prove to customers that your product isn’t different from what’s in the market. In other words, without differentiation, customers will question why they should buy your product instead of an alternative. |

4. Dynamic Pricing

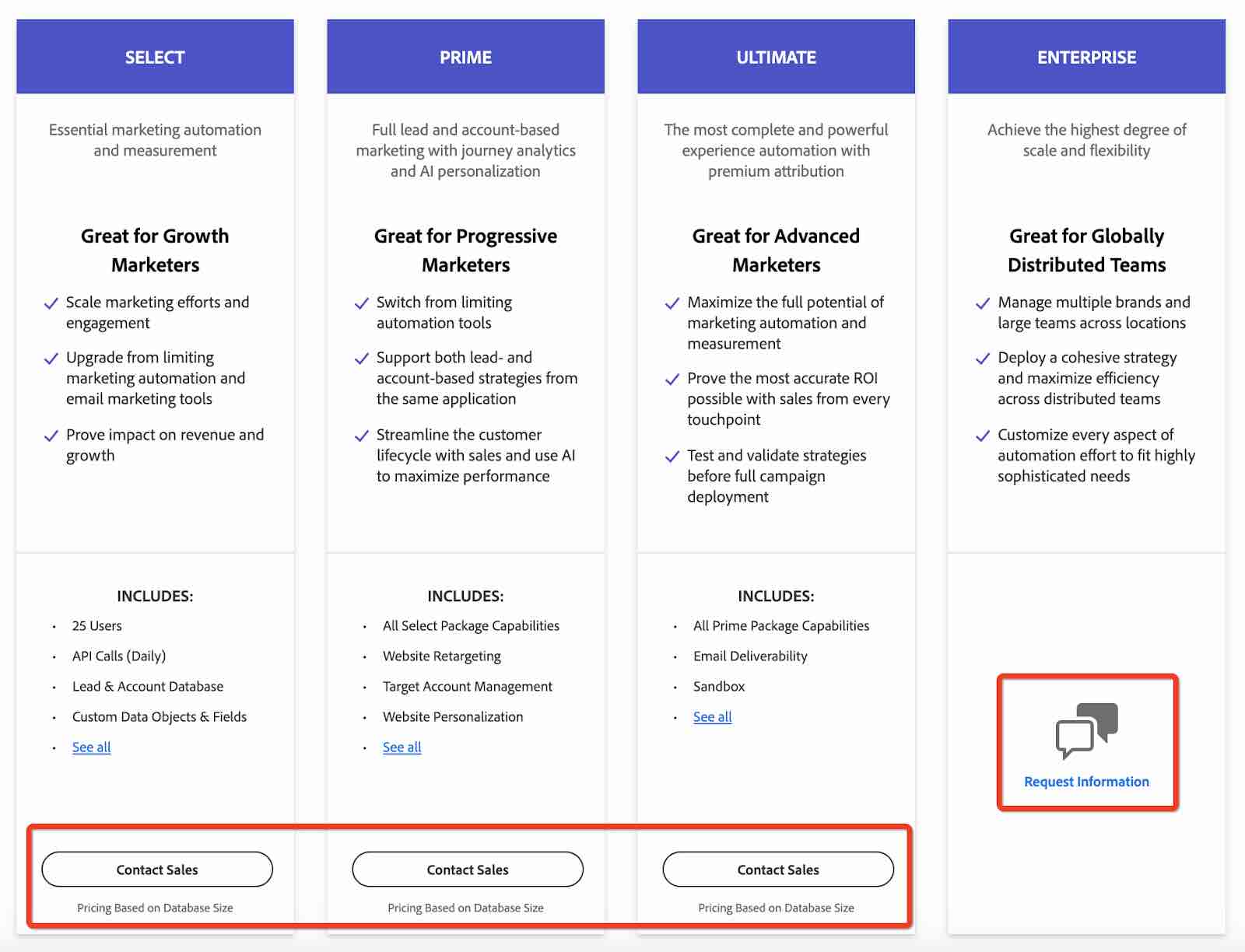

Many B2B companies use the segmented dynamic pricing strategy to sell their products to different customers. They do this by requesting users to contact their sales team for all or certain product tiers.

Here’s an example.

Using this strategy allows businesses to create customized solutions for every user, charge based on the product’s value, and adjust prices as market trends and conditions change.

However, this strategy is that it turns off potential users. When users land on your pricing page, they want to see the price of your product, not “contact sales.” Kieran Flanagan, our Senior VP of Marketing at HubSpot, echoes this point about pricing transparency.

"If Elon can make pricing for Rocket Ships transparent, then B2B companies can put their pricing on the website. pic.twitter.com/DwEpGjjOlm"

— Kieran Flanagan 🤘 (@searchbrat) August 17, 2021

| Pros of Dynamic Pricing |

Cons of Dynamic Pricing |

| You can apply rules to specific business groups based on their characteristics and market conditions, ensuring you have a suitable option for all audience segments. |

Prices that fluctuate because of market conditions may make consumers upset if the product becomes unaffordable. |

| You can easily adjust to competition price changes. |

Price fluctuation with the market may make revenue uncertain. |

How do B2B pricing models and strategies come together?

As they seem quite similar, it may be helpful to gain a final understanding of how B2B pricing models and B2B pricing strategies work together, so we’ll go over an example.

Say you’re a B2B business that charges other companies based on the number of users that will have access to what you’re selling. This is your pricing model.

As you sell in a competitive market, you want to come up with a price relevant to your competitors’ prices. You then charge a price between your two most significant competitors. This is your pricing strategy.

To sum it up, you’re charging businesses per user (pricing model), and the actual prices you charge them are based on the prices your competitors are charging (pricing strategy).

B2B Pricing Mistakes to Avoid

When setting prices for your product, be on the lookout for common B2B pricing pitfalls that can hinder your growth. Here are three common B2B pricing mistakes to avoid.

Mistake 1. Setting Prices Without Talking to Customers

No amount of research is better than talking to your customers. Your customers will be the users of your product. Chatting with them will help you uncover insights into the perceived worth of your solution.

As Tyler Gaffney, CEO of Zenhubputs it, “Founders must get out of their boxes— computer screen, office, city block — and meet with customers.”

Pro tip: Holding at least three meetings with some of your customers is an excellent start.

Mistake 2. Failing to Adjust Prices

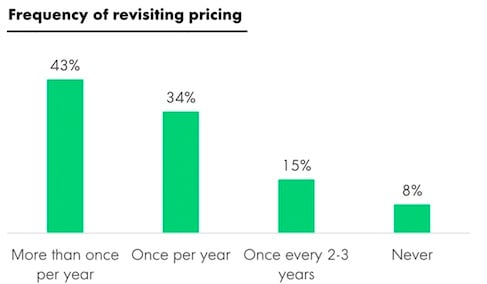

Many believe customers will walk if prices go up. This isn’t always the case. As your product gets better, its value increases, and your customers will notice. That’s why up to 77% of companies revisit their pricing at least once every year.

Image Source

Alt: Frequency of revisiting pricing: Over once per year 43%, Once per year 34%, Every 2-3 years 15%, Never 8%

IMG name: b2b-pricing-revisit.png

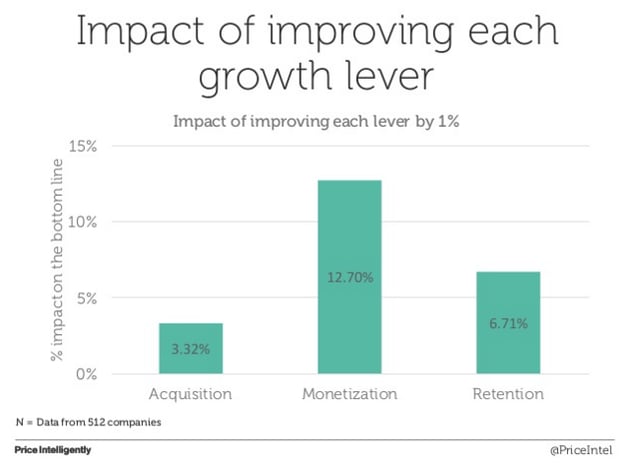

This approach prevents companies from putting a cap on their revenue. In fact, a survey of 512 companies by Price Intelligently shows a 1% change in pricing plan can increase the bottom line by up to 12.70%.

Whenever you adjust your price, one way to test its effectiveness is to benchmark your previous lifetime value (LTV) and customer acquisition cost (CAC) with the new one. If your LTV is higher and CAC is lower, that’s a success.

Mistake 3. Pricing Too Low

Undervaluing your product is one of the biggest B2B pricing mistakes to make. You didn’t pour resources into building your product, only to settle for the crumbs. Getting the entire loaf is a psychological play because people perceive higher-priced products to be of better quality. The opposite is also true.

So before deciding on the price points for your product, think hard about how you want customers to perceive your product.

It’s also important to remember that your product’s introductory price will play a significant role in your revenue for years to come.

You might have heard about the boiling frog syndrome. It’s the same with your introductory price. If a frog is in a pot of boiling water, it will immediately jump out to evade death. But if you place the frog in warm water and raise the temperature slowly, the frog will continuously adjust to the changing temperature.

The moral of the story is clear: A gradual change in price is better than sudden increases. Set low prices, and you’ll take longer to increase your rates in the future.

Pick a B2B pricing model, adopt a strategy, and avoid mistakes.

The pricing of your B2B product is crucial to the amount of revenue your company can generate.

Now that you know all about the models, strategies, and mistakes to avoid, it’s vital you prioritize pricing in your organization.

Remember, people pay for products because of how valuable they perceive them and what they help their organizations achieve. With this in mind, set your price, and continuously iterate on both your B2B product and your pricing.

Pricing Strategy

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)